Investing in a Vanguard IRA CD can be an excellent way to grow your retirement savings while enjoying the security and stability that certificates of deposit (CDs) provide. In today's uncertain financial climate, it's more important than ever to make informed decisions about your retirement funds. Whether you're just starting to explore retirement savings options or are looking to diversify your existing portfolio, understanding Vanguard IRA CDs is a crucial step toward securing your financial future.

Vanguard, one of the most trusted names in the financial industry, offers a wide range of investment options tailored to meet the needs of individual investors. Among these options, Vanguard IRA CDs stand out as a low-risk, fixed-income solution for those seeking predictable returns. In this article, we'll delve into the details of Vanguard IRA CDs, exploring their benefits, drawbacks, and how they fit into your overall retirement strategy.

By the end of this guide, you'll have a clear understanding of how Vanguard IRA CDs work, the factors to consider when choosing one, and how they compare to other investment options. Let's dive in and explore how these certificates of deposit can help you achieve your long-term financial goals.

Read also:Discover The Perfect Living Experience At Waterway Court Apartments

Table of Contents:

- Introduction to Vanguard IRA CDs

- Benefits of Vanguard IRA CDs

- Types of Vanguard IRA CDs

- Comparison with Other Retirement Accounts

- Risks and Considerations

- Eligibility and Contribution Limits

- Tax Implications of Vanguard IRA CDs

- Building a Diversified Retirement Strategy

- Frequently Asked Questions

- Conclusion and Call to Action

Introduction to Vanguard IRA CDs

Vanguard IRA CDs are a type of individual retirement account (IRA) that combines the tax advantages of an IRA with the stability and predictability of a certificate of deposit (CD). CDs are time-bound deposit accounts offered by banks and credit unions that typically pay higher interest rates than regular savings accounts. By placing a CD inside an IRA, investors can enjoy the benefits of tax-deferred growth while maintaining the security of their principal investment.

Why Choose Vanguard for Your IRA CD?

Vanguard is renowned for its commitment to low-cost investing and customer satisfaction. When you choose Vanguard for your IRA CD, you benefit from:

- Competitive interest rates

- Low fees and no account maintenance charges

- Excellent customer service

- Access to a wide range of investment options

Benefits of Vanguard IRA CDs

Vanguard IRA CDs offer several advantages that make them an attractive option for retirement savings:

1. Safety and Security

Certificates of deposit are among the safest investment vehicles available. When placed inside an IRA, they provide a reliable source of income with minimal risk. CDs insured by the Federal Deposit Insurance Corporation (FDIC) protect your principal investment up to $250,000 per account.

2. Predictable Returns

One of the key benefits of Vanguard IRA CDs is their ability to deliver consistent, predictable returns. Unlike stocks or mutual funds, which can fluctuate in value, CDs offer fixed interest rates that remain constant throughout the term of the investment.

Read also:Niall Horan Girlfriend Now The Complete Guide To His Love Life

3. Tax Advantages

By placing a CD inside an IRA, you can take advantage of tax-deferred growth. This means that any interest earned on your CD is not subject to immediate taxation, allowing your investment to grow more quickly over time.

Types of Vanguard IRA CDs

Vanguard offers several types of IRA CDs to suit different investment goals and risk tolerances:

1. Traditional IRA CDs

Traditional IRA CDs allow you to contribute pre-tax dollars to your retirement account. The interest earned on these CDs grows tax-deferred, but withdrawals made during retirement are subject to income tax.

2. Roth IRA CDs

Roth IRA CDs are funded with after-tax dollars, meaning that withdrawals made during retirement are tax-free, provided certain conditions are met. This makes Roth IRA CDs an attractive option for investors who expect to be in a higher tax bracket during retirement.

3. Education IRA CDs

Education IRA CDs, also known as Coverdell Education Savings Accounts (ESAs), are designed to help save for educational expenses. While not specifically retirement accounts, they offer similar tax advantages and can be used in conjunction with traditional or Roth IRAs.

Comparison with Other Retirement Accounts

While Vanguard IRA CDs offer many advantages, it's important to compare them with other retirement account options to determine which is best for your needs:

1. Vanguard IRA vs. 401(k)

Both Vanguard IRAs and 401(k) plans offer tax advantages for retirement savings, but there are key differences. 401(k) plans are employer-sponsored, often with matching contributions, while IRAs are individual accounts with greater investment flexibility.

2. Vanguard IRA vs. Mutual Funds

Mutual funds offer the potential for higher returns but come with greater risk. Vanguard IRA CDs, on the other hand, provide stability and predictability, making them a better choice for risk-averse investors.

Risks and Considerations

While Vanguard IRA CDs are generally considered low-risk investments, there are some factors to consider:

1. Early Withdrawal Penalties

Withdrawing funds from an IRA CD before the account reaches maturity can result in penalties. Additionally, early withdrawals from IRAs before age 59½ may incur a 10% tax penalty.

2. Inflation Risk

Although CDs offer fixed interest rates, they may not keep pace with inflation. This means that the purchasing power of your investment could decrease over time.

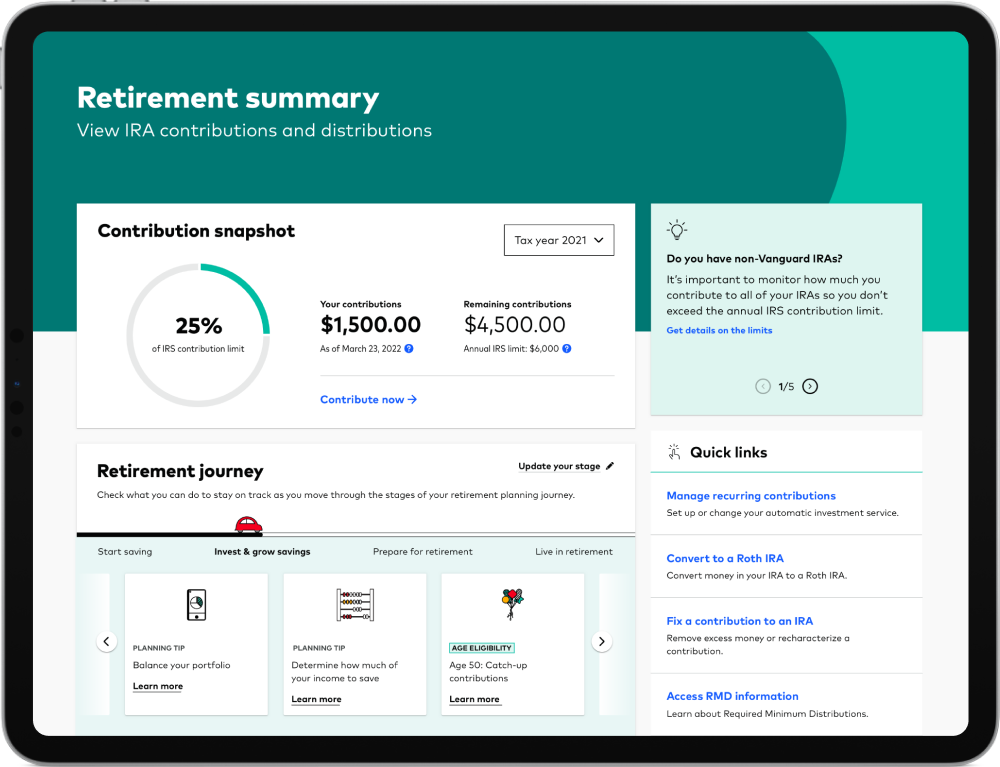

Eligibility and Contribution Limits

To participate in a Vanguard IRA CD, you must meet certain eligibility requirements and adhere to contribution limits:

1. Eligibility Requirements

Anyone with earned income can open a Vanguard IRA CD, provided they meet the minimum investment requirements. Traditional IRAs have no income limits, while Roth IRAs have income restrictions that may affect eligibility.

2. Contribution Limits

In 2023, the maximum contribution limit for IRAs is $6,500 per year, or $7,500 for those aged 50 and older. Contributions must be made with earned income and cannot exceed your total taxable compensation for the year.

Tax Implications of Vanguard IRA CDs

Understanding the tax implications of Vanguard IRA CDs is crucial for maximizing their benefits:

1. Tax-Deferred Growth

Interest earned on Vanguard IRA CDs grows tax-deferred, meaning you won't pay taxes on the earnings until you withdraw the funds during retirement.

2. Withdrawal Rules

Withdrawals from traditional IRA CDs are subject to income tax, while Roth IRA withdrawals are tax-free if the account has been open for at least five years and the account holder is at least 59½ years old.

Building a Diversified Retirement Strategy

While Vanguard IRA CDs can be a valuable component of your retirement portfolio, it's important to diversify your investments to minimize risk and maximize returns:

1. Balancing Risk and Reward

Consider combining Vanguard IRA CDs with other investment vehicles, such as stocks, bonds, and mutual funds, to create a balanced portfolio that aligns with your risk tolerance and financial goals.

2. Rebalancing Your Portfolio

Regularly review and rebalance your portfolio to ensure it remains aligned with your evolving financial needs and market conditions.

Frequently Asked Questions

1. Can I roll over a 401(k) into a Vanguard IRA CD?

Yes, you can roll over a 401(k) into a Vanguard IRA CD without incurring taxes or penalties, provided the rollover is completed within 60 days.

2. Are Vanguard IRA CDs FDIC-insured?

Yes, Vanguard IRA CDs are FDIC-insured up to $250,000 per account, providing added security for your investment.

3. What happens if I need to withdraw funds early?

Withdrawing funds from a Vanguard IRA CD before maturity may result in penalties. Additionally, early withdrawals from IRAs before age 59½ may incur a 10% tax penalty.

Conclusion and Call to Action

Vanguard IRA CDs offer a secure, predictable way to grow your retirement savings while enjoying the tax advantages of an IRA. By understanding the benefits, risks, and considerations associated with these investments, you can make informed decisions about your financial future.

We encourage you to take action today by exploring the options available through Vanguard and consulting with a financial advisor to create a personalized retirement strategy. Don't forget to share this article with others who may benefit from its insights, and feel free to leave a comment below with any questions or feedback.