The Virginia Department of Taxation plays a crucial role in managing state tax revenues and ensuring compliance with state tax laws. Whether you're a resident, business owner, or simply curious about how state taxes function, understanding this department is essential for financial planning and legal compliance.

As one of the most important administrative bodies in Virginia, the VA Department of Taxation oversees various tax programs, including personal income tax, sales and use tax, corporate income tax, and more. Its responsibilities extend to collecting taxes, providing taxpayer assistance, and enforcing tax laws.

This article will delve into the intricacies of the VA Department of Taxation, covering everything from its structure and responsibilities to practical tips for navigating its services. By the end, you'll have a clear understanding of how this department operates and how it impacts individuals and businesses alike.

Read also:Linda Cardellini In Scooby Doo A Comprehensive Look At Her Role And Impact

Table of Contents

- Introduction to the VA Department of Taxation

- Structure and Organization

- Key Tax Programs

- Ensuring Tax Compliance

- Resources for Taxpayers

- Filing Your Taxes in Virginia

- Business Taxation

- Tax Appeals Process

- Understanding Penalties and Interest

- Future of the VA Department of Taxation

- Conclusion

Introduction to the VA Department of Taxation

The VA Department of Taxation serves as the primary administrative body responsible for managing tax-related matters in the Commonwealth of Virginia. Established to ensure that all state taxes are collected fairly and efficiently, this department plays a pivotal role in funding public services and infrastructure.

One of the key responsibilities of the VA Department of Taxation is to administer various tax programs, including state income tax, sales tax, and excise taxes. Additionally, it provides guidance and resources to help taxpayers understand their obligations and rights under Virginia tax law.

Understanding the VA Department of Taxation is crucial for anyone living or doing business in Virginia. Whether you're filing your annual income tax return or navigating complex business tax issues, familiarity with this department can save you time, money, and potential legal complications.

Structure and Organization

Key Divisions Within the Department

The VA Department of Taxation is organized into several divisions, each focusing on specific aspects of tax administration. These divisions work together to ensure that all tax-related matters are handled efficiently and effectively.

- Revenue Division: Responsible for collecting and processing tax payments.

- Customer Service Division: Provides assistance and support to taxpayers.

- Legal Division: Handles tax disputes and ensures compliance with state tax laws.

- Information Technology Division: Manages the department's digital infrastructure and online services.

Each division plays a vital role in the department's overall mission, ensuring that taxpayers receive the support they need while maintaining the integrity of Virginia's tax system.

Key Tax Programs

Personal Income Tax

Virginia's personal income tax is one of the primary sources of revenue for the state. It is calculated based on a taxpayer's income and is subject to various deductions and credits. Understanding how personal income tax works is essential for ensuring that you pay the correct amount and take advantage of available tax benefits.

Read also:Nolan Baseball Rpi Unveiling The Power Of Ratings Percentage Index In College Baseball

Sales and Use Tax

The sales and use tax is another significant revenue source for Virginia. This tax is applied to most retail purchases and is collected by merchants at the point of sale. Businesses that sell taxable goods are required to remit the collected sales tax to the VA Department of Taxation.

According to a report by the Tax Foundation, Virginia's sales tax rate is competitive compared to other states, making it an attractive location for both consumers and businesses.

Ensuring Tax Compliance

Tax compliance is critical for avoiding penalties and maintaining a good relationship with the VA Department of Taxation. This involves not only paying your taxes on time but also keeping accurate records and reporting all relevant financial information.

To help taxpayers stay compliant, the department offers various resources, including online filing tools, tax calculators, and educational materials. By utilizing these resources, individuals and businesses can ensure that they meet their tax obligations without unnecessary complications.

Resources for Taxpayers

Online Services

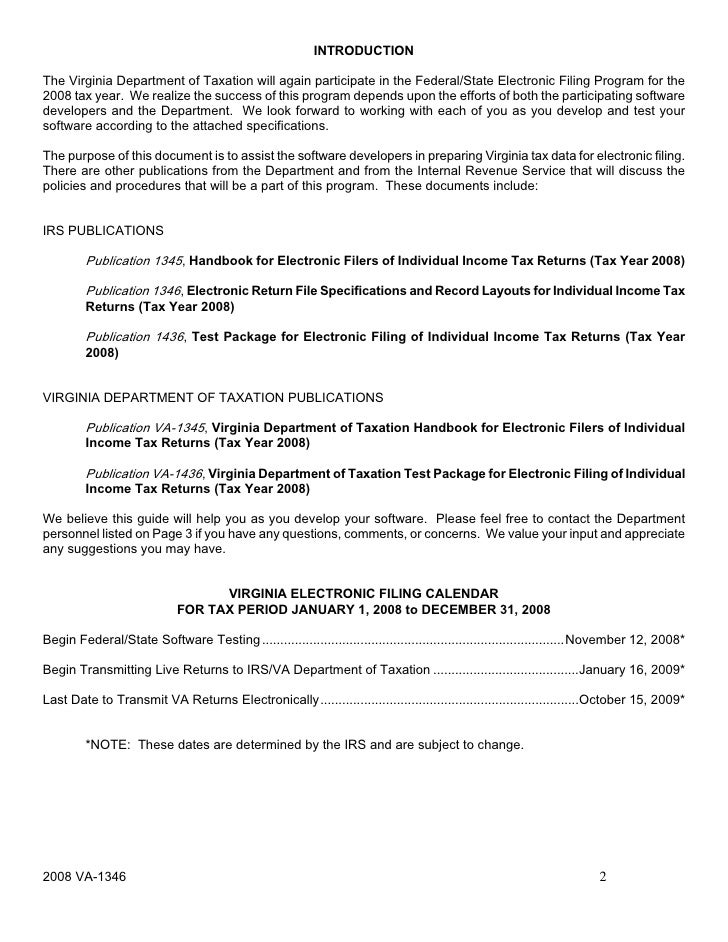

The VA Department of Taxation provides a range of online services designed to make tax filing and management easier for taxpayers. These services include:

- Electronic filing for individual and business tax returns.

- Access to account information and payment history.

- Tools for estimating tax liabilities and planning payments.

By leveraging these online resources, taxpayers can streamline their tax processes and reduce the likelihood of errors or missed deadlines.

Filing Your Taxes in Virginia

Deadlines and Requirements

Filing your taxes in Virginia involves adhering to specific deadlines and fulfilling certain requirements. For individual taxpayers, the deadline for filing state income tax returns typically aligns with the federal deadline, which is April 15th. However, extensions can be requested if needed.

Businesses must also file various tax returns throughout the year, depending on the type of business and its activities. It's important to familiarize yourself with these requirements to avoid penalties and ensure timely compliance.

Business Taxation

Corporate Income Tax

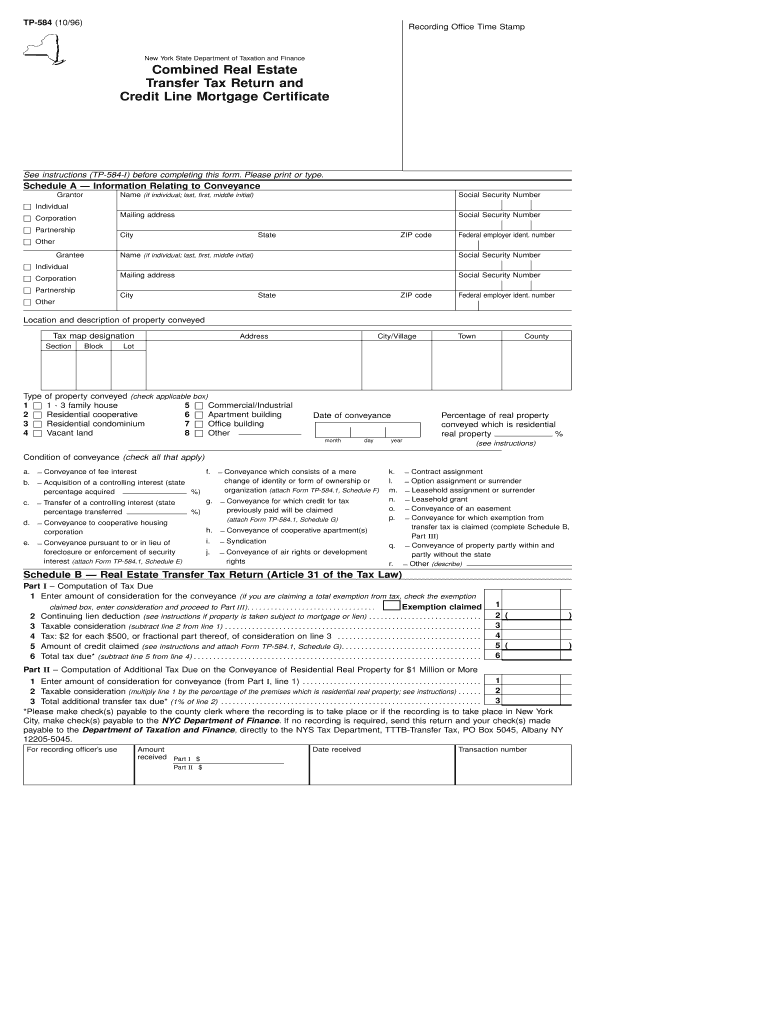

Virginia imposes a corporate income tax on businesses operating within the state. This tax is calculated based on the corporation's net income derived from Virginia sources. Understanding how corporate income tax works is essential for business owners and financial professionals.

Sales Tax for Businesses

Businesses that sell taxable goods or services in Virginia are required to collect and remit sales tax to the VA Department of Taxation. This process involves registering for a sales tax permit, collecting the appropriate tax from customers, and submitting payments on a regular schedule.

Data from the U.S. Census Bureau indicates that businesses contribute significantly to Virginia's tax revenue, underscoring the importance of proper sales tax management.

Tax Appeals Process

If you disagree with a tax assessment or decision made by the VA Department of Taxation, you have the right to appeal. The appeals process involves submitting a formal request and providing evidence to support your case.

It's important to note that the appeals process can be complex and may require legal assistance. Consulting with a tax professional or attorney can help ensure that your appeal is handled correctly and efficiently.

Understanding Penalties and Interest

Failing to comply with Virginia tax laws can result in penalties and interest charges. These penalties are designed to encourage timely compliance and deter intentional avoidance of tax obligations.

The VA Department of Taxation provides clear guidelines on penalties and interest rates, ensuring that taxpayers are aware of the consequences of non-compliance. By staying informed and proactive, you can avoid unnecessary financial burdens and maintain a positive relationship with the department.

Future of the VA Department of Taxation

As technology continues to evolve, the VA Department of Taxation is adapting its processes to meet the changing needs of taxpayers. This includes expanding online services, improving data security, and enhancing customer support.

Looking ahead, the department is likely to focus on increasing efficiency and accessibility while maintaining the integrity of Virginia's tax system. These efforts will help ensure that taxpayers continue to receive high-quality service and support in the years to come.

Conclusion

In conclusion, the VA Department of Taxation plays a vital role in managing Virginia's tax system and ensuring compliance with state tax laws. By understanding its structure, responsibilities, and resources, individuals and businesses can navigate tax-related matters more effectively and avoid potential complications.

We encourage you to explore the department's online services and resources to enhance your knowledge and simplify your tax processes. Don't hesitate to leave a comment or share this article with others who may benefit from the information provided. Together, we can promote financial literacy and compliance within the Commonwealth of Virginia.