Understanding the Montana Dept of Revenue is essential for residents, businesses, and taxpayers who want to navigate the state's financial landscape effectively. The department plays a crucial role in managing taxes, licenses, and other financial obligations. This article dives deep into its functions, responsibilities, and how it impacts everyday life.

The Montana Department of Revenue (MDR) serves as the backbone of the state's fiscal system, ensuring compliance with tax laws and collecting revenue to fund public services. Its mission is to provide efficient, fair, and transparent services to all Montanans. By understanding how this department operates, individuals and businesses can better plan their finances and avoid potential penalties.

In this guide, we will explore the various aspects of the Montana Dept of Revenue, including its history, key services, and the latest updates. Whether you're a resident, a business owner, or simply curious about how tax systems work, this article will provide valuable insights and actionable information to help you stay informed.

Read also:Shiloh Pitt The Extraordinary Journey Of An Iconic Child In Hollywood

Table of Contents

- History of Montana Dept of Revenue

- Key Services Provided by MDR

- Types of Taxes Managed by MDR

- Licensing and Registration

- Compliance and Audits

- Resources for Taxpayers

- Recent Updates and Changes

- Statistical Data on MDR Operations

- Frequently Asked Questions

- Conclusion and Call to Action

History of Montana Dept of Revenue

The Montana Department of Revenue has a rich history that dates back to the early 20th century. Established to manage the state's financial resources efficiently, the department has evolved significantly over the years to meet the changing needs of Montanans. Initially, its primary focus was on collecting property taxes, but it has since expanded its scope to include various other forms of revenue.

Key Milestones in MDR's History

Here are some of the key milestones in the history of the Montana Dept of Revenue:

- 1919: The department was officially established to oversee state taxation.

- 1940s: Expansion into income tax collection as the state's economy grew.

- 1980s: Introduction of electronic filing systems to improve efficiency.

- 2000s: Focus on digital transformation and taxpayer education.

Today, the Montana Dept of Revenue continues to innovate, ensuring that it remains relevant in an ever-changing fiscal environment.

Key Services Provided by MDR

The Montana Dept of Revenue offers a wide range of services designed to assist taxpayers and businesses. These services are crucial for maintaining financial stability and ensuring compliance with state regulations. Below are some of the key services provided by the department:

Read also:Where Is Desi Arnaz Jr Now A Comprehensive Look Into His Life And Career

1. Tax Collection

The department is responsible for collecting various types of taxes, including income tax, property tax, and sales tax. This ensures that the state has the necessary funds to support public services and infrastructure.

2. Licensing and Registration

MDR handles the licensing and registration of businesses, vehicles, and other entities. This includes issuing permits and ensuring that all entities comply with state regulations.

3. Compliance and Enforcement

The department enforces tax laws and ensures compliance through audits and investigations. This helps maintain fairness in the tax system and prevents fraud.

Types of Taxes Managed by MDR

The Montana Dept of Revenue manages several types of taxes, each with its own rules and regulations. Understanding these taxes is essential for individuals and businesses to meet their financial obligations effectively.

1. Income Tax

Montana imposes a state income tax on residents and businesses. The tax rates vary depending on income levels, and taxpayers must file annually. For more information, refer to the official MDR website.

2. Property Tax

Property taxes are levied on real estate and personal property. These taxes are used to fund local governments, schools, and other public services. Property owners must pay these taxes annually.

3. Sales and Use Tax

Sales tax is applied to most retail purchases in Montana. The rate varies by location, and businesses must collect and remit these taxes to the MDR.

Licensing and Registration

Licensing and registration are critical components of the Montana Dept of Revenue's operations. These processes ensure that businesses and individuals comply with state regulations and contribute to the state's revenue.

Business Licensing

Businesses operating in Montana must obtain the necessary licenses and permits from the MDR. This includes professional licenses, sales tax permits, and other industry-specific requirements.

Vehicle Registration

Vehicle owners must register their vehicles with the MDR and pay the associated fees. This process ensures that all vehicles comply with state regulations and contribute to road maintenance funds.

Compliance and Audits

Compliance with tax laws is essential for maintaining a fair and equitable system. The Montana Dept of Revenue conducts audits and investigations to ensure that taxpayers and businesses adhere to regulations.

Audit Process

During an audit, the MDR reviews financial records to verify that all taxes have been paid correctly. Taxpayers may be required to provide documentation and explanations for discrepancies.

Penalties for Non-Compliance

Failure to comply with tax laws can result in penalties, including fines and interest on unpaid taxes. It is crucial for taxpayers to stay informed and seek professional advice if needed.

Resources for Taxpayers

The Montana Dept of Revenue provides various resources to assist taxpayers and businesses in meeting their obligations. These resources include online tools, publications, and customer support services.

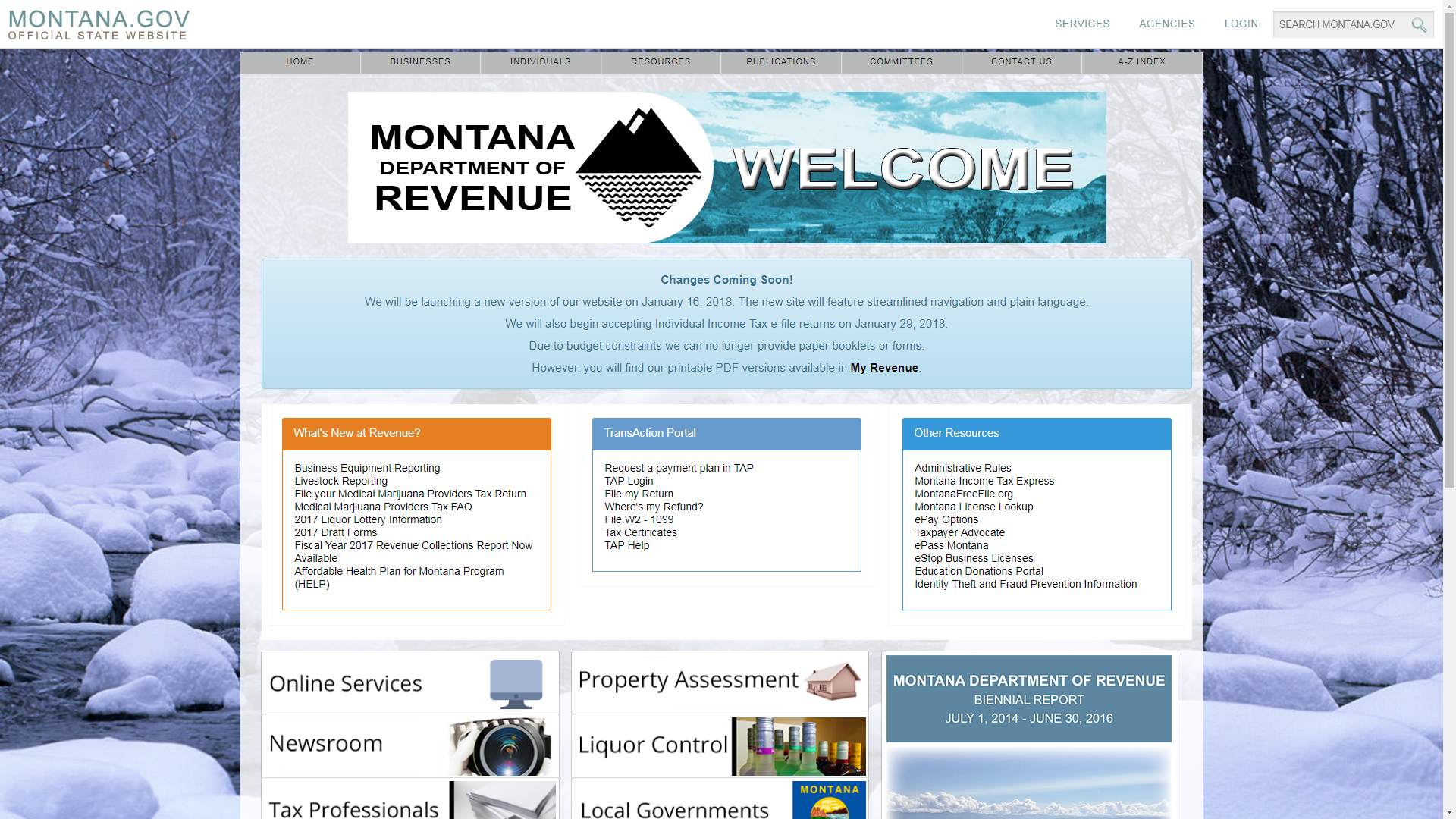

Online Services

MDR offers an online portal where taxpayers can file returns, pay taxes, and access account information. This portal is designed to make the tax process more convenient and efficient.

Publications and Guides

The department publishes guides and brochures that explain tax laws and procedures in detail. These resources are invaluable for taxpayers who want to stay informed and avoid common mistakes.

Recent Updates and Changes

The Montana Dept of Revenue regularly updates its policies and procedures to reflect changes in tax laws and regulations. Staying informed about these updates is essential for taxpayers and businesses.

Tax Law Changes

Recent updates include changes to income tax brackets, property tax assessments, and sales tax rates. These changes aim to improve fairness and accuracy in the tax system.

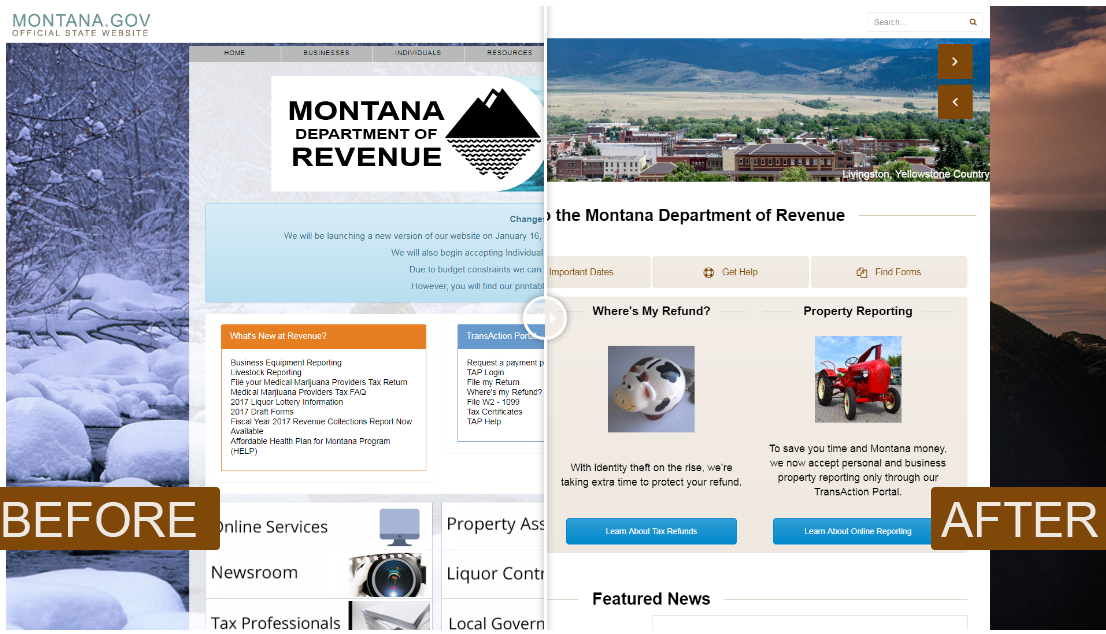

Technology Enhancements

The department continues to invest in technology to enhance its services. New features include improved online filing systems and mobile apps for easier access.

Statistical Data on MDR Operations

Data and statistics provide valuable insights into the operations of the Montana Dept of Revenue. Below are some key figures that highlight the department's impact:

- Total revenue collected in 2022: $X billion

- Number of taxpayers served annually: X million

- Average processing time for tax returns: X days

These statistics demonstrate the department's efficiency and effectiveness in managing state finances.

Frequently Asked Questions

Here are some common questions about the Montana Dept of Revenue:

Q: How do I file my state income tax return?

A: You can file your return online through the MDR portal or submit a paper form by mail. Ensure that you meet the deadline to avoid penalties.

Q: What happens if I miss the tax deadline?

A: Late filings may incur penalties and interest on unpaid taxes. It is advisable to file as soon as possible to minimize these costs.

Conclusion and Call to Action

In conclusion, the Montana Dept of Revenue plays a vital role in managing the state's financial resources. By understanding its functions and services, taxpayers and businesses can better navigate the tax system and fulfill their obligations effectively.

We encourage you to take action by reviewing your tax situation, utilizing the resources provided by MDR, and staying informed about updates and changes. Please share this article with others who may benefit from it and consider exploring additional content on our website for more insights into financial management.