As the demand for lithium continues to soar, lithium producers stock has become a hot topic in the investment world. With the global shift towards renewable energy and electric vehicles (EVs), lithium has emerged as a critical component in battery production. This growing demand has significantly impacted the stock market, making lithium producers an attractive investment option for both novice and seasoned investors.

This article aims to provide you with a detailed overview of lithium producers stock, including the top companies, market trends, and strategies for successful investment. Whether you're looking to diversify your portfolio or simply want to understand the dynamics of this rapidly evolving sector, this guide will help you make informed decisions.

By the end of this article, you'll have a comprehensive understanding of why lithium producers stock is worth considering and how you can capitalize on this lucrative opportunity. Let's dive in!

Read also:Jennifer Westfeldt Films A Comprehensive Look At Her Cinematic Journey

Table of Contents

- Introduction to Lithium Producers

- Top Lithium Producers in the Market

- Market Trends in Lithium Producers Stock

- Investment Strategies for Lithium Producers Stock

- Risks and Challenges in Lithium Investing

- Long-Term Potential of Lithium Producers Stock

- Understanding Lithium Supply and Demand Dynamics

- Geopolitical Factors Affecting Lithium Producers

- Sustainability and Environmental Concerns

- Technological Advancements in Lithium Extraction

Introduction to Lithium Producers

Lithium producers are companies involved in the extraction, processing, and distribution of lithium. This lightweight metal is a key component in rechargeable batteries, which power everything from smartphones to electric vehicles. The rise in EV adoption and the global push for clean energy have fueled the demand for lithium, making it one of the most sought-after commodities in the modern economy.

What Makes Lithium Producers Stock Attractive?

Several factors contribute to the attractiveness of lithium producers stock. First, the increasing adoption of electric vehicles has created a surge in demand for lithium-ion batteries. Second, governments worldwide are investing heavily in renewable energy projects, further boosting the need for lithium. Lastly, the limited number of major lithium producers creates a sense of exclusivity and potential for high returns.

Investing in lithium producers stock is not just about riding the wave of a booming industry; it's about aligning your investments with global trends and technological advancements.

Top Lithium Producers in the Market

When it comes to lithium producers, a few companies stand out due to their market dominance and innovation. Here are some of the top players in the lithium producers stock market:

- Albemarle Corporation: A global leader in lithium production, Albemarle has a strong presence in South America and Australia.

- SQM (Sociedad Química y Minera): Based in Chile, SQM is one of the largest lithium producers in the world.

- LiCo Energy Metals: A Canadian company focused on lithium exploration and development in North America.

- Ganfeng Lithium: A Chinese company known for its innovative lithium extraction technologies.

These companies not only dominate the market but also play a crucial role in shaping the future of lithium production.

Read also:Why Did Tasia Alexis Hussey Go To Jail Exploring The Facts Behind The Headlines

Market Trends in Lithium Producers Stock

The lithium market is experiencing rapid growth, driven by several key trends:

Growth in Electric Vehicle Adoption

As more countries commit to phasing out internal combustion engine vehicles, the demand for EVs is skyrocketing. This shift has directly impacted the lithium market, as EV batteries rely heavily on lithium-ion technology.

Renewable Energy Initiatives

Governments and private companies are investing heavily in renewable energy projects, such as wind and solar power. These projects require large-scale battery storage systems, further driving the demand for lithium.

Understanding these trends is essential for anyone looking to invest in lithium producers stock, as they provide insight into the industry's future growth potential.

Investment Strategies for Lithium Producers Stock

Investing in lithium producers stock requires a strategic approach. Here are some tips to help you make informed decisions:

- Research the Company: Before investing, thoroughly research the company's financial health, production capabilities, and market position.

- Diversify Your Portfolio: Spread your investments across multiple lithium producers to mitigate risk.

- Stay Updated on Market Trends: Keep an eye on industry news and global developments that could impact the lithium market.

By adopting these strategies, you can maximize your returns while minimizing potential risks.

Risks and Challenges in Lithium Investing

While investing in lithium producers stock offers significant potential, it's important to be aware of the risks and challenges involved:

Price Volatility

The price of lithium can fluctuate due to factors such as supply and demand imbalances, geopolitical tensions, and changes in government policies.

Regulatory Hurdles

Lithium producers often face regulatory challenges, particularly in countries with strict environmental laws. These regulations can impact production timelines and costs.

Being aware of these risks will help you make more informed investment decisions.

Long-Term Potential of Lithium Producers Stock

The long-term potential of lithium producers stock is immense. With the global push towards sustainability and clean energy, the demand for lithium is expected to continue growing. According to a report by BloombergNEF, the lithium market could reach $1 trillion by 2030, driven by the EV revolution and renewable energy initiatives.

Investors who position themselves early in this market stand to benefit significantly from its growth trajectory.

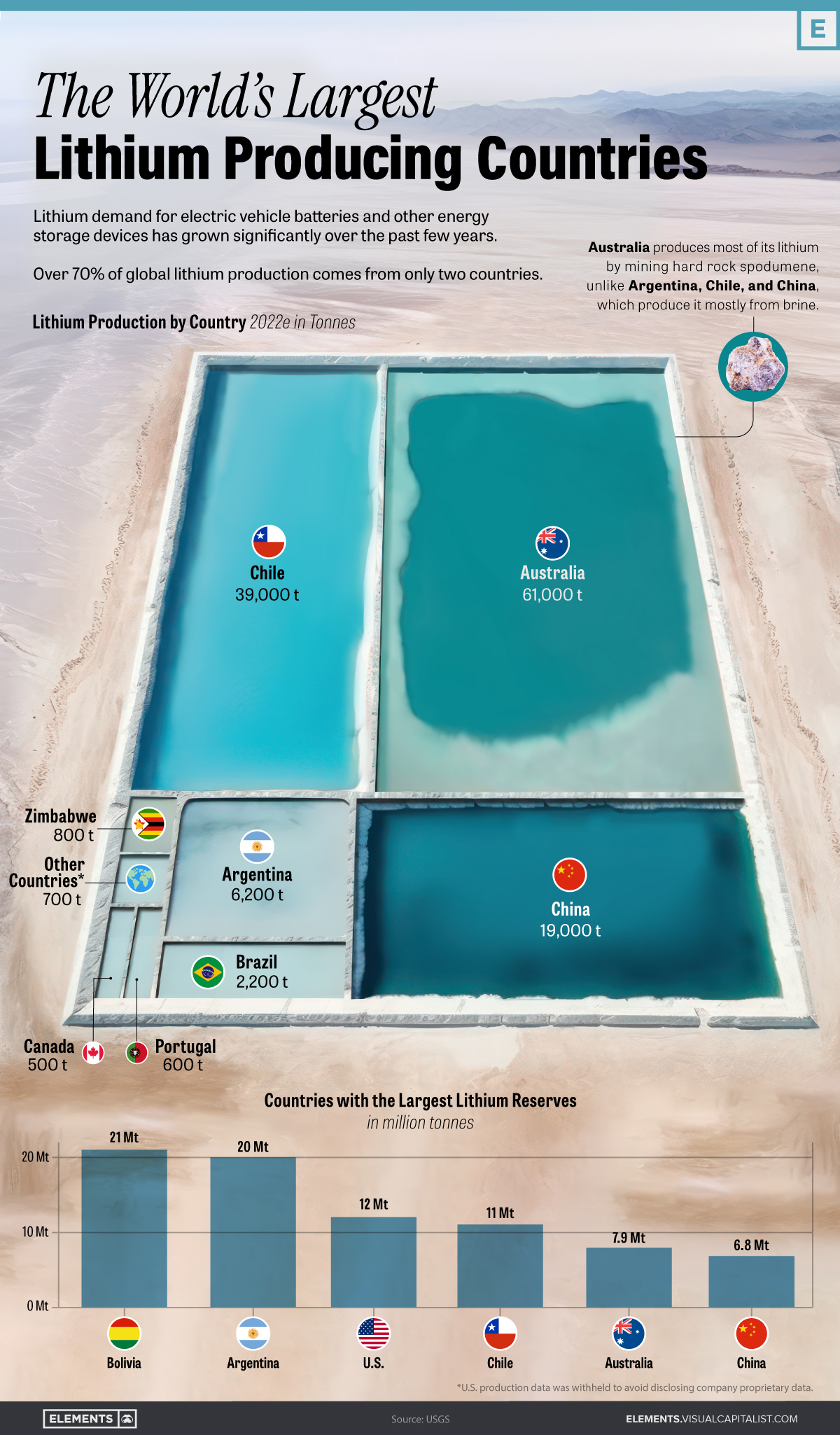

Understanding Lithium Supply and Demand Dynamics

The supply and demand dynamics of lithium play a crucial role in determining the market's direction. Currently, the demand for lithium exceeds its supply, creating a favorable environment for lithium producers stock. However, as new mining projects come online, the supply could increase, potentially impacting prices.

Monitoring these dynamics is essential for understanding the market's future movements.

Key Statistics on Lithium Demand

According to the International Energy Agency (IEA), the demand for lithium is projected to grow by 40% annually over the next decade. This growth is largely driven by the EV industry, which accounts for nearly 70% of global lithium consumption.

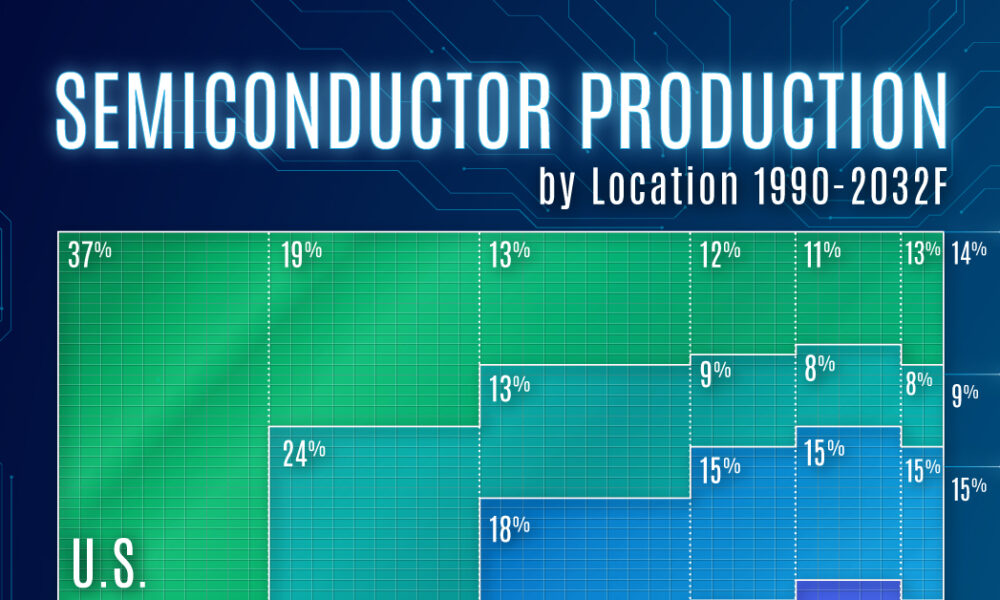

Geopolitical Factors Affecting Lithium Producers

Geopolitical factors can significantly impact the lithium market. For instance, trade tensions between major lithium-producing countries and their trading partners can disrupt supply chains and affect prices. Additionally, changes in government policies, such as subsidies for EVs or restrictions on mining, can influence the market.

Staying informed about geopolitical developments is crucial for investors in lithium producers stock.

Sustainability and Environmental Concerns

As the world moves towards sustainability, environmental concerns surrounding lithium mining have come to the forefront. Issues such as water usage, land degradation, and carbon emissions are being closely monitored by environmentalists and regulatory bodies.

Companies that prioritize sustainable practices and innovation in extraction methods are likely to gain a competitive edge in the market.

Technological Advancements in Lithium Extraction

Technological advancements are revolutionizing the way lithium is extracted and processed. Innovations such as direct lithium extraction (DLE) promise to reduce costs and environmental impact, making lithium production more efficient and sustainable.

Investors should keep an eye on companies investing in these technologies, as they are likely to lead the market in the future.

Kesimpulan

In conclusion, lithium producers stock offers a promising investment opportunity in the rapidly growing renewable energy and EV sectors. By understanding the market trends, risks, and long-term potential, investors can make informed decisions and capitalize on this lucrative market.

We encourage you to share your thoughts and experiences in the comments section below. Additionally, consider exploring other articles on our site to deepen your knowledge of the stock market and investment opportunities. Remember, staying informed is the key to successful investing!