Property taxes play a pivotal role in shaping the financial landscape of Travis County, Texas. The Travis County Appraisal District (TCAD) serves as the cornerstone for property valuation, ensuring fair and accurate assessments for all residents. Whether you're a homeowner, investor, or business owner, understanding how TCAD operates is crucial for managing your financial responsibilities effectively.

The Travis County Appraisal District is a government entity responsible for determining the market value of all properties within the county. This process ensures that property taxes are assessed fairly and equitably. As property values fluctuate due to market conditions, economic changes, and improvements, TCAD plays a critical role in maintaining transparency and accountability in the tax system.

This article delves deep into the intricacies of the Travis County Appraisal District, providing comprehensive insights into its operations, significance, and the steps you can take to navigate property tax assessments. Whether you're looking to contest your property value or simply understand the appraisal process better, this guide is designed to equip you with the knowledge you need.

Read also:Synonyms Uncover Exploring The Depth Of Word Relationships

Table of Contents

- Introduction to Travis County Appraisal District

- The Role of TCAD in Property Valuation

- Understanding the Property Tax System in Travis County

- The Property Appraisal Process

- How to Contest Your Property Value

- Property Tax Exemptions and Benefits

- The Impact of TCAD on Homeowners

- Frequently Asked Questions About Travis County Appraisal District

- Useful Resources and Tools

- Conclusion and Next Steps

Introduction to Travis County Appraisal District

The Travis County Appraisal District (TCAD) is a vital government entity tasked with the responsibility of appraising all properties within Travis County. Established under Texas law, TCAD ensures that property values are assessed fairly and accurately, forming the foundation of the county's property tax system. Understanding the role of TCAD is essential for anyone who owns property in the area.

The district operates independently but collaborates closely with local taxing entities such as school districts, cities, and counties. This collaboration ensures that property taxes are distributed equitably based on assessed values. TCAD employs professional appraisers who utilize advanced technologies and data-driven methods to evaluate properties.

Key Functions of TCAD

Here are the primary functions of the Travis County Appraisal District:

- Conducting annual property appraisals

- Maintaining accurate property records

- Processing property tax exemptions

- Facilitating appeals and protests

The Role of TCAD in Property Valuation

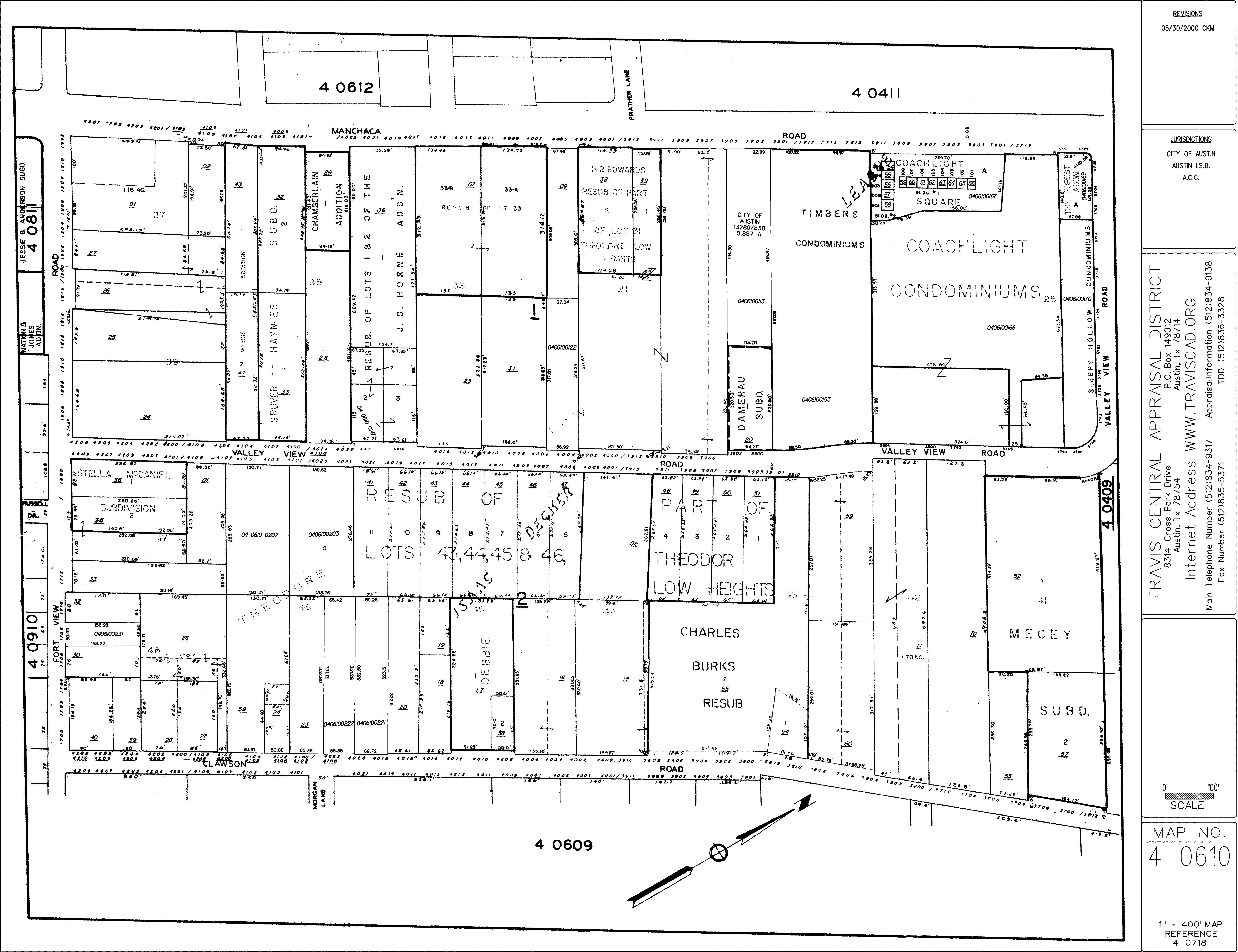

Property valuation is at the heart of TCAD's operations. The district uses a combination of market analysis, property inspections, and historical data to determine the market value of each property. This process is crucial for ensuring that property taxes reflect the current market conditions and are distributed fairly among property owners.

TCAD adheres to strict guidelines set by the Texas Property Tax Code to maintain transparency and accuracy in its appraisals. The district also provides property owners with the opportunity to contest their appraised values if they believe the assessment is inaccurate.

Market Value vs. Appraised Value

It's important to distinguish between market value and appraised value:

Read also:Zoe Kravitz And Lisa Bonet Exploring Their Legacy Bond And Influence

- Market Value: The price a willing buyer would pay and a willing seller would accept for a property in an open market.

- Appraised Value: The estimated value assigned by TCAD based on market analysis and property characteristics.

Understanding the Property Tax System in Travis County

The property tax system in Travis County is designed to fund essential public services such as education, infrastructure, and emergency services. Property taxes are calculated based on the appraised value of a property and the tax rates set by local taxing entities.

TCAD plays a critical role in this system by providing accurate and up-to-date property valuations. The district works closely with local governments to ensure that tax revenues are allocated appropriately. Property owners are notified of their appraised values annually and have the opportunity to contest these values if necessary.

How Property Taxes Are Calculated

The formula for calculating property taxes is straightforward:

- Appraised Value - Homestead Exemptions = Taxable Value

- Taxable Value x Tax Rate = Property Tax Amount

The Property Appraisal Process

The property appraisal process involves several steps to ensure accuracy and fairness. TCAD begins by collecting data on each property, including its size, location, age, and condition. This data is then analyzed to determine the property's market value.

Once the appraisals are complete, property owners receive a notice of their appraised value. If the owner disagrees with the assessment, they can file a protest with the Travis Central Appraisal District.

Steps in the Appraisal Process

Here are the key steps involved in the appraisal process:

- Data collection and analysis

- Property inspection (if necessary)

- Market value determination

- Notification of appraised value

- Protest and appeals process

How to Contest Your Property Value

If you believe your property value has been overestimated, you have the right to contest the appraisal. The first step is to file a protest with the Travis County Appraisal Review Board (ARB). This board reviews appeals and makes final decisions on property value disputes.

To strengthen your case, gather evidence such as recent sales of comparable properties, property condition reports, and any other relevant documentation. Presenting a well-documented case increases your chances of a favorable outcome.

Tips for a Successful Appeal

Consider the following tips when contesting your property value:

- Gather comprehensive evidence

- Submit your protest by the deadline

- Attend the ARB hearing prepared

- Seek professional assistance if needed

Property Tax Exemptions and Benefits

Travis County offers several property tax exemptions to eligible residents. These exemptions reduce the taxable value of a property, resulting in lower tax bills. Common exemptions include homestead exemptions, senior citizen exemptions, and disability exemptions.

To qualify for these exemptions, property owners must meet specific criteria and submit the necessary documentation. TCAD processes exemption applications and ensures that eligible properties receive the appropriate benefits.

Types of Property Tax Exemptions

Here are some of the most common property tax exemptions:

- Homestead Exemption

- Over 65 Exemption

- Disabled Veteran Exemption

- Energy Efficiency Exemption

The Impact of TCAD on Homeowners

The Travis County Appraisal District has a significant impact on homeowners in the area. Accurate property valuations ensure that homeowners pay their fair share of property taxes while protecting them from over-assessment. TCAD also provides resources and support to help homeowners navigate the complexities of the tax system.

By maintaining transparent and accountable practices, TCAD fosters trust and confidence among property owners. This trust is essential for ensuring compliance and cooperation within the community.

Benefits for Homeowners

Here are some of the benefits homeowners receive from TCAD:

- Accurate property valuations

- Access to exemptions and benefits

- Opportunities to contest appraisals

- Support and resources for understanding taxes

Frequently Asked Questions About Travis County Appraisal District

Here are some common questions and answers about TCAD:

Q1: What is the deadline for filing a property tax protest?

The deadline for filing a protest varies each year, but it typically falls in May. Check the TCAD website for the exact date.

Q2: How often does TCAD conduct property appraisals?

TCAD conducts annual property appraisals to ensure values remain current and accurate.

Q3: Can I appeal a property tax decision?

Yes, you can appeal a decision made by the Appraisal Review Board by filing a lawsuit in district court.

Useful Resources and Tools

For more information on the Travis County Appraisal District, visit the following resources:

- Travis County Appraisal District Official Website

- Texas Comptroller of Public Accounts

- U.S. Department of the Treasury

Conclusion and Next Steps

The Travis County Appraisal District plays a critical role in maintaining a fair and transparent property tax system. By understanding how TCAD operates and utilizing the resources available, property owners can ensure they are paying their fair share while protecting their financial interests.

We encourage you to explore the resources mentioned in this article and take advantage of the exemptions and benefits offered by TCAD. If you have questions or concerns about your property tax assessment, don't hesitate to reach out to TCAD for assistance.

Call to Action: Share this article with fellow property owners in Travis County and leave a comment below with your thoughts or questions. Together, we can foster a better understanding of the property tax system and promote financial literacy in our community.