Ally Financial Overnight Payoff Address is a critical piece of information for individuals managing loans, auto financing, or other financial obligations. Whether you're settling a car loan, refinancing, or simply seeking clarity on your financial transactions, understanding the correct payoff process is essential. This guide will provide comprehensive insights into Ally Financial's overnight payoff address and related procedures.

Managing finances can be daunting, but having accurate information at your fingertips makes the process smoother. Ally Financial, a leading financial institution, offers various financial products, including auto loans, mortgages, and personal loans. Ensuring that you have the correct payoff address is crucial for avoiding delays or errors in your financial transactions.

In this article, we will delve into the specifics of the Ally Financial Overnight Payoff Address, explore related procedures, and provide practical tips to ensure smooth financial transactions. Whether you're a first-time borrower or a seasoned finance enthusiast, this guide will equip you with the knowledge you need.

Read also:The Menendez Brothers Family Photos A Deep Dive Into Their Tragic Story

Table of Contents

- Introduction to Ally Financial

- Understanding the Payoff Process

- Ally Financial Overnight Payoff Address

- Steps to Complete a Payoff

- Common Questions About Payoff Addresses

- Tips for a Successful Payoff

- Subheading: Importance of Correct Information

- Subheading: Avoiding Common Mistakes

- Subheading: Verifying Payoff Details

- Conclusion and Next Steps

Introduction to Ally Financial

Ally Financial, a prominent financial services company, specializes in offering a wide range of financial products, including auto loans, mortgages, and personal loans. Established with a focus on customer satisfaction and innovative financial solutions, Ally has become a trusted name in the industry.

For borrowers, understanding the intricacies of loan payoff processes is essential. Ally Financial provides specific guidelines and addresses for overnight payoff transactions, ensuring that payments are processed efficiently and securely.

This section will explore the background of Ally Financial, its role in the financial sector, and why accurate information about payoff addresses is vital for borrowers.

Understanding the Payoff Process

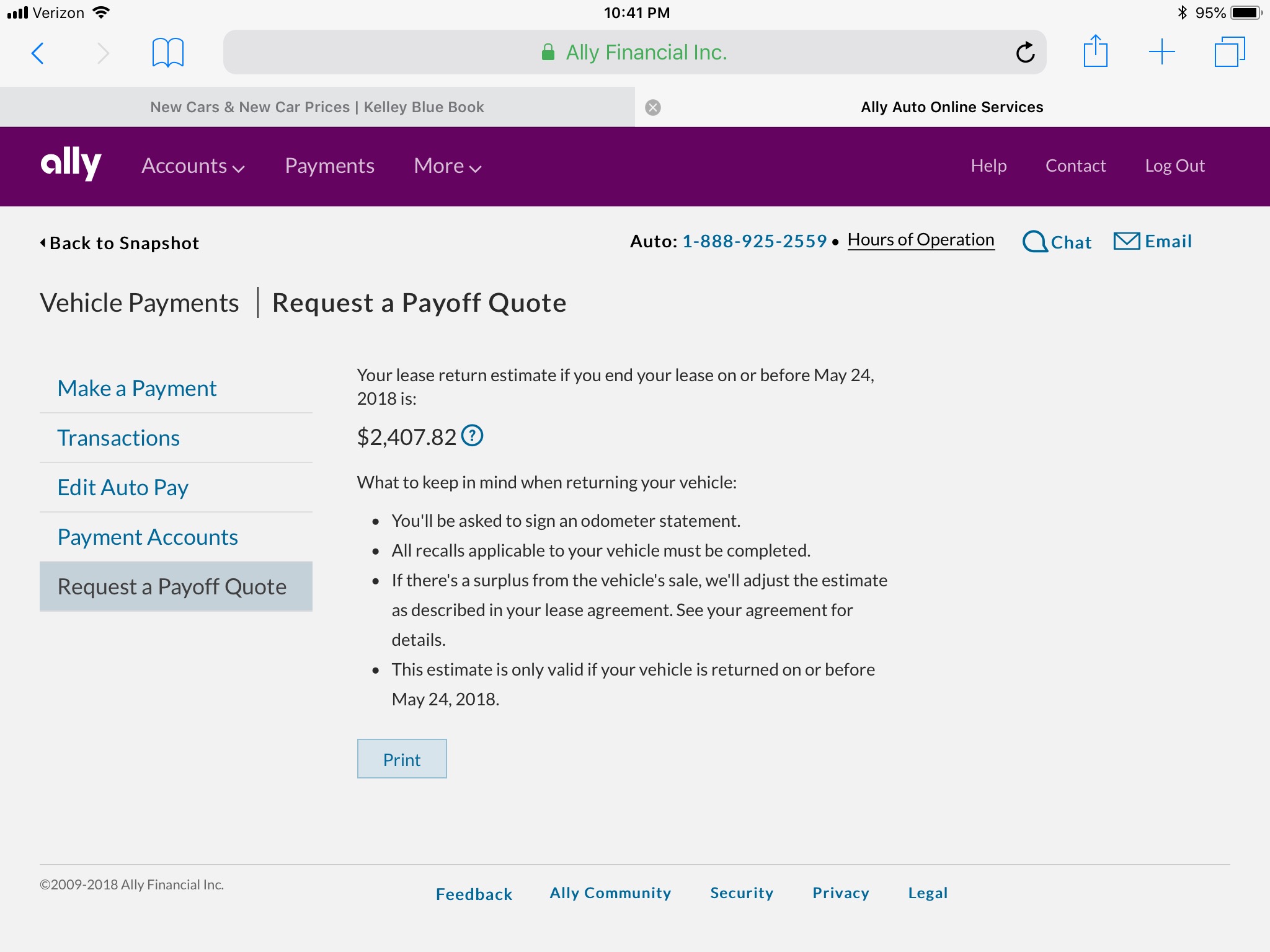

Before diving into the specifics of the Ally Financial Overnight Payoff Address, it's important to understand the broader payoff process. Paying off a loan involves several steps, from requesting a payoff quote to ensuring that the payment is received and processed correctly.

Here are the key steps involved in the payoff process:

- Requesting a payoff statement from Ally Financial

- Verifying the amount due and ensuring accuracy

- Selecting the appropriate payment method, such as wire transfer or overnight check

- Submitting the payment to the correct address

Each step plays a crucial role in ensuring a smooth and successful payoff transaction.

Read also:Does Dr Phil Support Trump A Comprehensive Analysis

Ally Financial Overnight Payoff Address

One of the most critical aspects of the payoff process is knowing the correct Ally Financial Overnight Payoff Address. This address ensures that your payment is received promptly and processed without delays. The overnight payoff address for Ally Financial is:

Ally Financial

P.O. Box 380901

Minneapolis, MN 55438-0901

It's important to note that this address is specifically for overnight payments, such as checks sent via courier services like FedEx or UPS. For other payment methods, such as wire transfers, different procedures may apply.

Steps to Complete a Payoff

Completing a payoff with Ally Financial involves a series of well-defined steps. Here's a detailed breakdown of the process:

Step 1: Request a Payoff Statement

Contact Ally Financial to request a payoff statement. This statement will include the total amount due, the payoff date, and any additional fees or charges.

Step 2: Verify Payment Details

Double-check the payoff amount and ensure that all details are accurate. Any discrepancies should be addressed immediately with Ally Financial's customer service team.

Step 3: Choose a Payment Method

Select the most convenient payment method for your situation. Options include wire transfers, certified checks, or overnight checks sent to the designated payoff address.

Step 4: Submit Payment

Once you've chosen your payment method, submit the payment to the correct address. Ensure that all necessary documentation, such as the payoff statement or reference number, accompanies your payment.

Common Questions About Payoff Addresses

Many borrowers have questions about the payoff process and the correct addresses to use. Below are some frequently asked questions and their answers:

- Q: Can I use the same address for all payment methods?

A: No, the overnight payoff address is specific to courier-sent checks. Wire transfers and other payment methods may require different procedures. - Q: What happens if I send the payment to the wrong address?

A: Payments sent to incorrect addresses may result in delays or processing errors. Always verify the address before sending your payment. - Q: How long does it take for a payoff to be processed?

A: Processing times vary depending on the payment method. Overnight checks typically take 1-2 business days, while wire transfers may be processed within 24 hours.

Tips for a Successful Payoff

To ensure a seamless payoff experience with Ally Financial, consider the following tips:

- Request your payoff statement well in advance to allow time for verification.

- Use certified or overnight checks for faster processing.

- Include all necessary documentation with your payment to avoid delays.

- Keep a record of your payment, including tracking numbers and confirmation emails.

By following these tips, you can minimize the risk of errors and ensure that your payoff is processed efficiently.

Subheading: Importance of Correct Information

Using the correct payoff address is crucial for avoiding delays and ensuring that your payment is processed promptly. Incorrect information can lead to returned payments, missed deadlines, and additional fees. Always double-check the address and payment details before submitting your payment.

Subheading: Avoiding Common Mistakes

Some common mistakes borrowers make during the payoff process include:

- Sending payments to the wrong address

- Failing to include necessary documentation

- Not verifying the payoff amount before payment

By staying vigilant and following the outlined steps, you can avoid these pitfalls and ensure a successful payoff.

Subheading: Verifying Payoff Details

Before finalizing your payoff, it's essential to verify all details with Ally Financial. This includes confirming the payoff amount, the correct address, and the expected processing time. Contacting customer service or using online resources can help ensure accuracy and peace of mind.

Conclusion and Next Steps

In conclusion, understanding the Ally Financial Overnight Payoff Address and the associated payoff process is critical for borrowers seeking to settle their financial obligations efficiently. By following the outlined steps, verifying payment details, and avoiding common mistakes, you can ensure a smooth and successful payoff experience.

We encourage you to take the following actions:

- Request your payoff statement from Ally Financial today.

- Verify all payment details and ensure accuracy.

- Share this article with others who may benefit from the information.

For more insights into financial management and loan payoff processes, explore our other articles and resources. Your financial well-being is our priority, and we're here to help you every step of the way.

![Ally Auto Overnight Payoff Address [FREE ACCESS]](https://overnightaddressfinder.com/wp-content/uploads/2024/04/Ally-Auto-Overnight-Payoff-Address.jpg)